(832) 581-3553

Insurance Claims

We understand that filing an insurance claim can sometimes be a daunting process. We’re here to help. There are several factors to consider in making an educated decision to move forward with a homeowner’s claim for storm damages to your property. We offer a free consultation with you to consider such factors as:

The extent of damages to your property

We do a thorough inspection to assess all aspects of damage. For the exterior, this may include: roofing, rain gutters, windows, garage doors, fencing, awning structures, paint, siding, a/c units, playsets, patio furniture, etc. For the interior, this may include: drywall, paint, insulation, structural/framing, etc.

For roof damages, we understand you may be less than enthused to climb up there with us, and that’s ok. We’ll provide photo evidence of roof damages we may find to show you after we get down. We tend to get photos with background points of reference, for your assurance of authenticity. If you’re not afraid of heights and have scaled your roof before, please join us up there if you’d like to, though not recommended for steeper sloped roofs. We have special shoes and training so as to be safe while up there. Drone photography is available for steeper, less accessible roofs, though a more comprehensive evaluation may be performed firsthand.

Allowances in your policy to remediate damages

Before fully encouraging a policyholder to initiate a claim, importance is stressed to be well aware of what provisions, or deductions, will be applied to their approved claim. Sometimes it’s as easy as pulling out a copy of your policy on file. A call to your agent can also be made for certain points of clarity.

Long and Short Term Goals

Let’s discuss what your short or long term intentions are for your valued investment, and if proceeding with the claim will make sense in that regard.

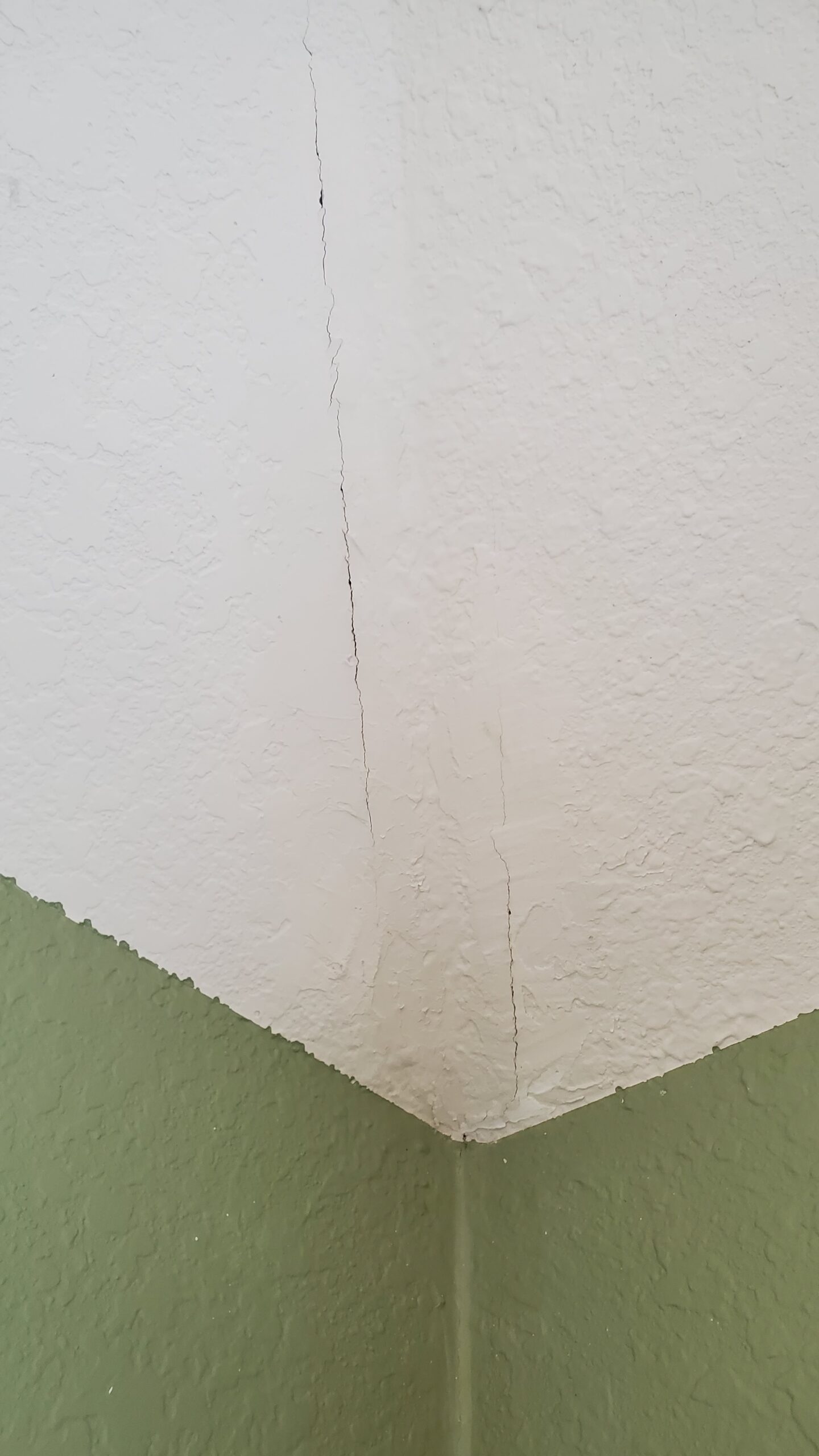

Claim Images

Here are some images from some of the claims we’ve handled.

Making an Insurance Claim

We don’t mind discouraging a potential customer from making a claim, even if it should mean not getting their business. What matters most to us is would it ultimately be of benefit to the homeowner/policyholder to do so? With your assistance, an honest and educated assessment is what we’ll offer. Should it make better sense to file the claim, we will gladly meet with your insurance representative on the time/date of inspection to be of assistance in that process.

Should it be that your claim has already been filed and your property inspected by an insurance adjuster, we can still be of assistance, and likely to your benefit.

It’s often the case that pricing inaccuracies and insubstantial damage assessments are in an initial claim estimate. We can review your claim estimate with you to advise you of its accuracy, and what remedial approach may be needed as part of our free consultation. If your claim was denied and you perhaps have doubts as to the accuracy of the adjuster’s assessment, we’d still like to offer our own assessment along with advise on a remedial approach. It’s always good to consider that an initial inspection and assessment of your property damage by your insurance company is not necessarily a matter of “case closed”.

Moving forward in agreement, we acquire bids and schedule the work commencement of each agreed trade as listed in your claim. We’ll also keep you well informed of the scheduling of those trades so as not to be of inconvenience to you or your family.

We carefully handle invoicing to your insurance company for release of withheld funds, such as depreciation or supplements, and will also facilitate the check endorsement process should your mortgage company also be named on your checks.

In short, we’re here to help make the process as simple, painless, and beneficial as possible for each valued customer. By offering top notch quality workmanship, materials, and experienced professionalism in claims handling, we’ll bring your insurance project to its finality with your assured satisfaction. Call or write us today for a free consultation!